Innovations in technology make disruptive changes to the business landscape. By incorporating automation and adopting cutting-edge solutions, organizations can accelerate their business processes and earn greater profits. Unsurprisingly, 70% of organizations prioritize digital transformation initiatives, as the adoption of new technology is often a catalyst for growth.

Likewise, the Accounts Payable industry is adopting disrupting technology to optimize the manual process and bring forth new features that were not available before. Features such as Intelligent Data Capture and advanced machine learning and analytics are eliminating slow and manual processes.

As we enter the new decade, we can expect to see the adoption of Accounts Payable trends in the upcoming years. Although most Accounts Payable trends have been building up for years, these trends will be adopted on a much larger scale in 2021. In this article, we will discuss upcoming accounts payable trends in 2021.

Leveraging Business Critical Financial Data

In the past few years, accounts payable has changed from a transaction-oriented back-office operation to an intelligence hub that gives you strategically important insight into your business.

Although removing manual processes and optimizing operational efficiencies is a good reason to adopt an automated AP solution, there are other major benefits of adopting these solutions, as well.

Automated AP solutions give organizations greater visibility to business-critical data, which is an equally important feature as automating manual processes. As we see greater adoption of AP solutions, we will also witness greater use of business-critical financial data.

For the past years, data science has been one of the most sought-after fields in IT. It helps organizations derive business insights from existing data and helps them optimize existing processes and strategies with the help of those insights. With financial services expecting a 26% CAGR data growth between 2018 and 2025, we can expect greater applications of data science in AP processes, as well.

Although accessing invoice data in a user-friendly format can help an organization, leveraging that data for informed decision-making has a greater impact on businesses. Data-driven decisions can help companies improve performance and take the business forward. We can see the application of data technologies in areas such as cash flow management, spend analysis, strategic sourcing, and working capital.

AP automation solutions have the potential to give an in-depth insight into a company’s financial operations. C-suite executives and internal stakeholders in procurement and finance can accelerate organizational growth and success by leveraging business-critical data.

AI and Machine Learning Becomes a Necessary Feature in AP Automation

AI and machine learning are the secret ingredients that transform efficient software into intelligent solutions. In the coming decade, we can expect a greater implementation of AI and machine learning in AP solutions.

According to Forrester, around 60 to 73% of business data remains unused. However, since with the rise of data science companies will be keener to leverage finance data more efficiently.

As we discussed above, utilizing business-critical data can provide significant benefits to organizations worldwide. With the help of data science techniques, we can transform unused data into structured information and then use it to streamline automation procedures to a greater degree of efficiency.

These techniques will enhance the quality of data derived from accounts payable processes. For instance, solutions such as Intelligent Data Capture can automatically detect errors in manual data entry and correct them based on pre-defined rules.

Likewise, leveraging AI and machine learning is necessary to optimize advanced AP automation functionality. These intelligent solutions can recommend coding and distribution for non-PO invoices. Furthermore, we can also utilize insight given by these solutions for configuring tolerance levels for PO-invoices. Such initiatives can help AP departments to minimize exception management and implement a fully automated process.

Automation Is Becoming a Necessity

AP automation has been consistent with accounts payable trends in recent years. Although many companies are yet to implement AP automation, the disrupting role of this technology is encouraging a growing number of businesses to adopt it.

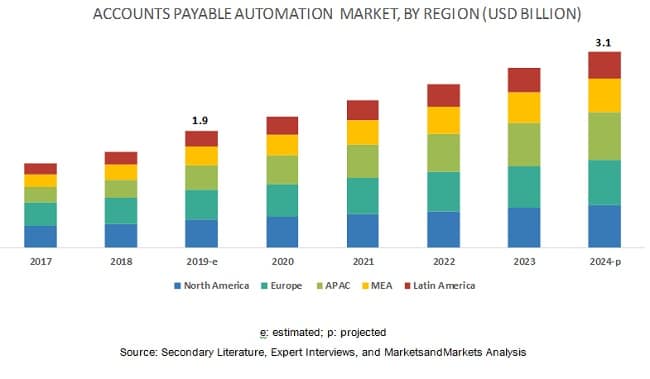

We can see this phenomenon by looking at the CAGR of AP Automation market, which is growing at the rate of 11%. What used to be considered a luxury for large enterprises has seen rapid adoption in various industries. Experts predict that the AP automation market alone will reach a market size of $3 billion by 2024.

One major reason behind this is that Accounts Payable influences the day-to-day business operations of almost every major industry. These processes have a direct impact on cash flow management; are responsible for maintaining vendor relationships, and provides security against fraud.

However, due to manual interventions, the efficiency of accounts payable processes is deeply compromised. Manual interventions prevent AP staff from using their time optimally and restrict them from time-intensive and tedious processes.

Accounts Payable Automation reduces unnecessary manual intervention with some advanced solutions reducing as much as 90% of payable invoices. It uses a collection of technologies such as intelligent data capture, document imaging, and optical character recognition (OCR) to automate manual processes.

Furthermore, the emergence of cloud-based AP automation solutions has made its implementation scalable, easier and faster than ever before. As a result, these solutions are now available to businesses of all sizes from small businesses to large enterprises.

In today’s digital and fast-moving business landscape, automating accounts payable is not a luxury, but a necessity to stay relevant. The solution gives your organization unprecedented time-saving and data accuracy.

At the same time, it provides data insights that help increase spend visibility, financial control, and unearths cost-saving opportunities. So, if your organization hasn’t adopted AP automation yet, it could face a significant disadvantage compared to other companies.

Download for free: A complete Guide to Invoice Processing Automation

The Adoption of Cloud Technology for Widespread Availability

As it’s always the case in most major technologies, large enterprises are the quickest to adopt digital solutions for optimizing their business operations. This often happens because these organizations have huge budgets that allow them to adopt new technologies before they are available to other businesses.

So, it shouldn’t come as a surprise that enterprises were the earliest adopters of AP automation, as well. While previously small and mid-sized businesses could access these solutions, it was difficult for them to keep up with the massive infrastructure costs of deploying enterprise solutions.

However, with the emergence of cloud-based AP automation solutions, it has become easier to counter these problems. Cloud-based automation solutions enable businesses to scale AP automation services depending on their usage. This helps businesses of all sizes to reap the countless benefits of AP automation without putting a strain on their budget.

At the same time, due to the interconnected nature of today’s global economy processing supplier payment has become increasingly complex. Companies need to be ready to tackle varying compliance regulations and process vendor invoices accordingly.

An automated cloud-based AP solution is much more flexible and keeps the system updated with complex compliance requirements. It is easier to introduce and share new features and product upgrades with all cloud customers simultaneously.

By adopting a cloud-based AP automation solution in 2020, companies of all sizes can reap the benefits of continuous innovations. These solutions can enable businesses to stay ahead of their competition by maximizing accounts payable process efficiency.

Operational Efficiency Continues to Be a Key Benchmark in AP Automation

Although the US B2B payments market is worth a massive $22 trillion, the industry has been slow to digitize. As much as 36% of firms are still relying on paper invoicing with47% sticking to manual processes for approval and the rest of them making 49% of payments by check.

With manual processes still being used by a significant portion of the market, we can expect AP automation solutions to be used for greater efficiency. In fact, according to Business Insider’s Account Payable Automation report, 44% of businesses are looking to incorporate automation into AP processes so they can maximize their efficiency and cost-cutting opportunities.

Similarly, a recent survey by HSBC and Forbes Insights reports that 44% of respondents rated operational efficiency as their top growth strategy for 2020. So, in the coming days, we can expect operational efficiency to be a top driver for the adoption of AP automation in finance departments

Since AP automation solutions can take over 40% of day-to-day functions, the rest of human resources can utilize their time performing more value-adding tasks, such as supplier management, process optimization, and data analysis.

Conclusion

In conclusion, in the coming years, we will witness the continuation of major AP automation trends in 2021. Organizations will need to utilize AP solutions to maximize efficiency in their accounts payable operations.

Although AP automation solutions have been around the market for a while, thanks to cloud-based AP solutions, we will witness a greater adoption of AP automation in the coming years.

At the same time, we will see organizations giving greater importance to business-critical data and using it to make informed decisions about their business. Similarly, businesses will process this data more efficiently using intelligent solutions and cutting-edge technologies such as Intelligent Data Capture.